Property, Economics and the Environment

A proper definition and understanding of the concept of private property is essential to discussing environmental issues.

In any discussion of an environmental issue — whether it involves land use, contaminated waterways or air pollution — the concept of property is always at the forefront. While the concept is always present, its definition and use can become a confusing maze instead of serving as a rubric for one to judge issues in a logical, wertfrei manner.

Werfrei is a German term which means neutral with regard to value judgments. When one says they are looking at things in a wertfrei manner, such as economist, they mean that action A will bring about result X. This means looking at whether means will arrive at ends — nothing more.

The first step, then, in discussing environmental politics is defining the concept of private property. The reader may want to take on this challenge: in the course of reading any article, text or book on property rights, see if the author gives a clear definition of property.

Once this task has be accomplished — that is, establishing a theoretical groundwork — all the other steps logically fall in place — one can then address different types of goods or property, the attributes of those different kinds of property, what gives property value, the voluntary interactions between people and their exchange of property, i.e., an economy, the role of property in the topic of conservation and finally pollution and the role of the law.

Property: In Person

The average discussion on property might immediately start with a question such as “Do I own my land? Do I own the acreage upon which my house sits?” While it is a valid question, it jumping one step ahead of the question at hand. In order for one to own a piece of land, one would need to be in control of their body that allowed them to get to that land — in short, one must own oneself. This is the first link in a discussion of property.

The vital steppingstone of self-ownership comes from John Locke. The following quote — while lengthy — is necessary, for it clearly defines the concept of property and its implications:

Every man has a Property in his own Person. This no Body has any Right to but himself. The Labour of his body, and the Work of his Hands, we may say, are properly his. Whatsoever then he removes out of the State that Nature hath provided, and left it in, he hath mixed his Labour with, and joyned to it something that is his own, and thereby makes it his Property. It being by him removed from the common state Nature placed it in, it hath by this labour something annexed to it, that excludes the common right of other Men … He that is nourished by the Acorns he pickt up under an Oak, or the Apples he gathered from the Trees in the Wood, has certainly appropriated them to himself. No body can deny but the nourishment is his. I ask then, When did they begin to be his? When he digested? … And ’tis plain, if the first gathering made them not his, nothing else could. That labour put a distinction between them and common … will any one say he had no right to those Acorns or Apples he thus appropriated, because he had not the consent of all Mankind to make them his? … If such a consent as that was necessary, Man had starved … We see in Commons, which remain so by Compact, that ’tis the taking any part of what is common, and removing it out of the state Nature leaves it in, which begins the Property; without which the common is of no use … The labour that was mine, removing them out of that common state they were in, hath fixed my Property in them.

Locke outlined a clear and distinct process: self-ownership, i.e., one’s body is that person’s property and one mixes their labor to acquire other property. Indeed, without the concept of property no further analysis of any kind of interaction between two people is possible.

As economist Hans-Hermann Hoppe has said, “A definition and theory of property must precede the definition and establishment of all other economic terms and theorems.”

If person A were not the owner of their physical body only two alternatives would be available: another person, B, would be the owner of all goods appropriated, produced or contractually acquired by A or A and B would be equal co-owners of both parties bodies and goods. Hoppe outlines the ambiguity and hence, invalidity of these claims:

In the first case, A would be B’s slave and subject to exploitation … two distinct classes of people would be created — exploiters (B) and exploited (A) — to whom different “law” would apply .. this rule fails the “universalization test” … for in order to be able to claim a rule to be a “law” (just), it is necessary that such a rule be universally — equally — valid for everyone. In the second case … each activity of a person requires the employment of scarce goods … Yet if all goods were the collective property of everyone, then no one, at any time and in any place, could ever do anything with anything unless he had every other co-owner’s prior permission to do what he wanted to do.

Property: In Goods

Now that it has been logically established that each person owns their physical body the next step—since Locke’s process of mixing labor, i.e., homesteading, has been discussed—is to elaborate on how property outside an person’s physical body comes to be. Property is a prerequisite for discussing inter-actor action, but property must be employed in the satisfaction of a want on the part of an actor.

A person only homesteads property that is scarce. If something is not scarce, e.g., the amount of air, then the potential for conflict is almost nonexistent. Air is known, in economic terms, as a condition of general human welfare or a free good.

Commenting on the nature of goods, Rothbard states:

Any good is always scarce and therefore must always command a price in accordance with the demand for it and the supply available. The only “free goods” on the market are not goods at all, but abundant conditions of human welfare that are not the subject of human action.

This is because it is so abundant and the act of acquiring air, i.e., merely breathing in, is so simple and autonomous that no scarce means, e.g., one’s time and labor, are put into acquiring the good.

However, if conditions change, such as when one goes underwater where air is not a condition of general human welfare, then one will be willing to pay for air. Likewise when one goes into outer space, that person pays for air. Indeed, people pay to have their air “conditioned” in various ways, e.g., central heat or air in a building. Air in all these later scenarios has turned into a scarce good.

Free goods are important but the majority of what is available on the Earth is not as abundant and as easily acquirable as air. All other goods are either (a) immediately and directly serviceable in the satisfaction of an actor’s wants or (b) used in the production of directly serviceable goods that will be available at some point in the future. The first group are called consumer’s goods and the second are called producer’s goods.

The nature of these various classes of goods—consumer’s goods and producer’s goods—shows that in order for a person to exist, for lack of a better word, that a person must “exploit” nature. Labor, by itself is just that, labor—it must to be mixed with nature-given factors to produce something that an actor desires. This is in accordance with the basic physics principle of “no creation ex nihilo” known simply as “something cannot come into existence out of nothing.”

A person must mix their labor with nature-given factors in order to obtain the fruits of their labor. Nature does not provide something like a fishing pole, but an actor can use his labor to collect various sticks to assemble the final product. Nearly every product available today is pulled from nature and assembled into something completely original that was not inherently present in the state of nature.

Appropriation of Nature-given Factors

As has been noted above, a person takes owned property and mixes his labor with the property to produce various kinds of goods. If an actor cannot appropriate property, then that actor cannot produce goods.

But what are the rules that govern who gets what piece of property? As noted in the Locke quote above, any piece of nature that has never been used is unowned and the property of the first person to mix their labor with that resource.

The resource must go to the first user. If it does not go to the first user, then who? The second, third or the fourth? If it is denied that property cannot go to the first user, then arbitrary decree has taken the place of homesteading.

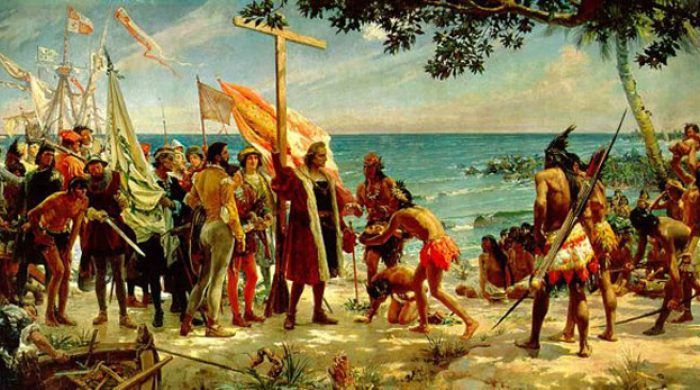

The fact that resource goes to the first user does not get rid of some of the confusion over the process of homesteading. Economist Murray Rothbard pointed this out with his illustration of Columbus landing in the New World:

If Columbus lands on a new continent, is it legitimate for him to proclaim all the new continent his own, or even that sector “as far as his eye can see”? Clearly, this would not be the case … Columbus … would have to use the land, to “cultivate” it in some way, before he could be asserted to own it. This “cultivation” does not have to involve tilling the soil, although that is one possible form of cultivation. If the natural resource is land, he may clear it for a house or a pasture, or care for some plots of timber, etc. If there is more land that can be used by a limited labor supply, then the unused land must simply remain unowned until a first user arrives on the scene.

Wolowski and Levasseur reinforce this position:

Nature has been appropriated by him (man) for his use; she has become his own; she is his property. This property is legitimate; it constitutes a right as sacred for man as is the free exercise of his faculties. It is his because it has come entirely from himself, and it is in no way anything but an emanation from his being. Before him, there was scarcely anything but matter; since him, and by him, there is interchangeable wealth.

A common quip to the first use, first ownership criterion is offered by many who believe that either “society” or the State owns certain areas of nature-given factors. Some groups, such as the Georgists, put forth the idea that State would own all the land and then give each person “unconditional right of access to the soil” while charging a single, land tax. Even countries with some private property rights, e.g., the United States, still preserve certain areas of land for “public use.”

However, this position is contradictory. For, outside the first user, first owner practice, only one of two events can occur, either (1) some actor homesteads a piece of property and the State then takes the property or the actor leaves the property to the State or (2) the State claims a title to particular land that has not been homesteaded by any actor.

This is exactly what happened in U.S. history with the ill-named Homestead Act. The government claimed title to land in the West and then set arbitrary rules governing titles to property. It limited property to 160 acres with the condition that one had to be at least 21 years old and built and lived in a house of a particular size for five years. If one did not want to wait five years, they could buy land for $1.25 an acre after six months.

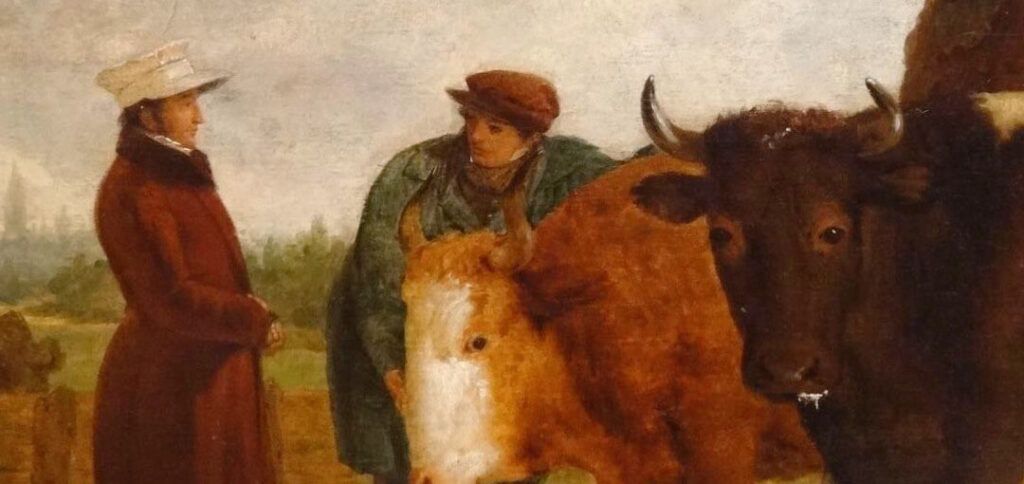

While land has been the topic at hand, homesteading, it must be remembered, extends to all nature-given factors that can be appropriated by an actor. One of the first nature-given factors, outside of land, that must be dealt with are animals. Animals, like land, are original factors of nature. And what does the someone like the rancher do? He mixes his labor by domesticating, e.g., a group of cows, fencing them off on his property, providing them with food and at a later date sells them for other uses.

The homesteading rule still holds in the case of a group of animals, such as fish, that are constantly moving because the other nature-given factor which the inhabit, i.e., water, is constantly moving. In the case of fishing rights, the fishing rights would still go to the first user. If one fishes in an area three yards by three yards wide he would have homesteaded that area.

An important question may arise, “How can that actor homestead that area? The water and fish are constantly moving.” This is a valid claim, but like the rancher that can fence his cows and keep them constrained to his property, so could a fisher. Until the area could be fenced off — using some kind of underwater fencing — the property owner would have to be aware that the fish and water can move from his property to another piece of property — owned or in the commons. This is an entirely possible scenario for areas of the ocean are marked by longitudes and latitudes which would make the boundaries of property distinct.

The Exchange of Property and the Nature of Value

Since it has been shown that each actor owns their own person, appropriates nature-given factors via homesteading and then takes those nature-given factors and turns them into goods, it is now time to look at the role of a free market.

If anything is more misunderstood than the concept of private property, it is a free market, i.e., capitalism. The disconnect is not illogical. If one does not understand property, than it should not be surprising that the free market is misunderstood.

What is the market? It is merely the voluntary interaction among people and the exchange of their private property. Property — whether it is a plot of land, a fishing pole or television set — is being exchanged two actors.

In an act of exchange, e.g., Jones sells Smith four apples for $1, what is being exchanged are property titles. Economist Thomas DiLorenzo writes, “private property is the most important distinguishing feature of capitalism.” Jones is selling Smith the right to those four apples and then Smith is free to do what he wants with those apples. The stressing of the term “property titles” is important. For once an analysis moves from the exchange of a physical good to that of a service — which is still considered a good in economic terms — the “title” part becomes evident.

Take Jones and Smith again. Suppose Jones sells Smith his labor services of harvesting apples for $6 an hour. Smith has not bought Jones or his labor, but secured the title — at the negotiated price — to Jone’s labor for that set amount of time. Jones can leave at any time or Smith can fire Jones. Hence, the property title can stay — provided both Smith and Jones continue to be satisfied with the arrangement — or can wither away if either party decides it should stop. Unlike the case of the apple purchase — where the property has physically left Jones and gone to Smith — with a service what is being contracted is some good for a set period of time.

When two actors engage in an exchange each actor expects to benefit. Going back to Jones and Smith, Jones sold his apples because he valued the $1 more than the four apples and Smith gave his $1 to Jones because he valued the four apples more than the $1. All trades — including the aforementioned example — take place because of unequal or inverse valuation. Each actor must value what they are getting more than what they are giving away. This stresses the subjective nature of all value in all acts of exchange, i.e., capitalism or a free market.

Economist Carl Menger was one of the first to stress the subjective, unmeasurable nature of value:

Value is nothing inherent in goods and … is not a property of goods. But neither is value an independent thing. There is no reason why a good may not have value to economizing individual but no value to another individual under different circumstances. The measure of value is entirely subjective in nature, and for this reason a good can have a great value to one economizing individual, little value to another, and no value at all to a third, depending on the differences in their requirements and available amounts. What one person disdains or values lightly is appreciated by another, and what one person abandons is often picked up by another. While one economizing individual esteems equally a given amount of one good and a greater amount of another good, we frequently observe just the opposite valuations with another economizing individual.

A lot of confusion arises about the perception of the free market because of the inability to grasp the aforementioned subjective nature of value. The alternative — the labor theory of value — confuses many. Indeed, it might even confuse the reader because earlier the discussion centered on the mixing of one’s labor with a nature-given resource to appropriate property. But labor serves just that function — to appropriate the property — it does not give it value.

The labor theory of value was put forth by such classical economists as Adam Smith and David Ricardo. The most well-known proponent of it was Karl Marx. The argument put forth is that the labor time put into a good gives a good value. Yet the argument does not hold water. David Gordon points this out:

Everyone knows that some people are much more efficient workers than others. You might build a wooden bookend in a few hours, but it would take me several years to do it. Will my bookend be worth several times more than yours? Of course not! Economic value, then, does not depend on the the labor time required to produce something.

A common criticism is that only “socially necessary” labor determines value, i.e., the market price. What determines what labor is “socially necessary”? It is the subjective evaluations of consumers and producers. This is why labor is not one abstract lump sum. Is the bricklayer’s labor the same as the labor of the lawyer?

The wages for these different types of professions are determined by their demand and supply — which is rooted in the subjective wants of people. It is apparent that even the labor theory of value — which tries to be objective — not only is logically inconsistent, but must appeal to the subjective nature of individuals evaluations to ultimately come up with some price.

To step outside the subjective nature of value and claim that certain goods have an objective or intrinsic value is to miss the point of why a person acts. Each actor, through his actions, demonstrates a preference for one state of affairs over another. This concept, quite simply, is called demonstrated preference. Rothbard notes that actual choice reveals,

or demonstrates, a mans preferences; that is, that his preferences are deducible from what he has chosen in action. Thus, if a man chooses to spend an hour at a concert rather than a movie, we deduce that the former was preferred, or ranked higher on his value scale. Similarly, if a man spends five dollars on a shirt we deduce that he preferred purchasing the shirt to any other uses he could have found for the money. This concept of preference, rooted in real choices, forms the keystone of the logical structure of economic analysis, and particularly utility and welfare analysis.

This comes full circle to the nature of exchange — action is not possible without property and one cannot deem certain goods more sacrosanct than others without engaging in interpersonal evaluations.

As Richard Epstein notes, “A system of private rights, for example, only specifies how property is acquired and what means are used to transfer it from one person to another. It does not specify what things must be acquired, when they must be transferred, or what price is to be paid.”

Nature-given Factors: Private Versus Public

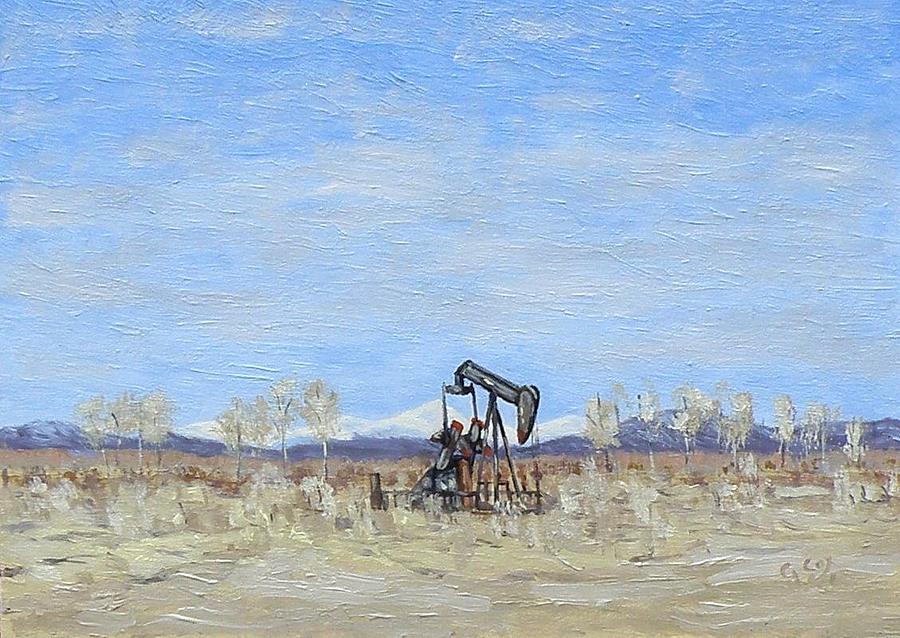

All action uses means to arrive at ends. This means that some form of property must be deemed useful to an actor — based on that actor’s own subjective evaluation — before it can be employed toward an end. From the actor that fashions a small campfire using sticks and stones on his property to the company that drills for oil to sell on the free market to the actor that simply enjoys the sight of his garden—all are employing a means that they deem suitable for an end. The earlier discussion focused on the process of homesteading and the necessity of private property.

However, there are nature-given factors, such as forests, oceans, rivers, etc., that many argue are exempt from appropriation, i.e., the establishment of private property rights, and should be subject to special government rules and intervention that are not present in other areas of a free market.

It should be noted that a resource like forests is usually considered a “public” resource, yet of the 737 million acres of woodlands in the United States, 58 percent are owned by individuals, estates or businesses. There are about 10 million private forest owners in the United States.

The most common argument laid out against government control of nature-given factors where there are no private property rights is known as the “tragedy of the commons.” The model — illuminated by Garrett Hardin — stresses that when a resource is open to everyone it tends to be exploited.

An example of this is the claim of “over-fishing” in the New England fisheries. Since the nature-given factor — the ocean and the fish in it — is open to everyone, the incentive for fishers is to collect as many fish as possible and get out, since they do not know whether they will have fishing rights a day, week, month or year from the present catch.

These New England fishermen are unsure of fishing rights because legislation dating back to 1976 — under the title of the Magnuson Fisheries Conservation and Management Act — that allows the U.S. government “to administer the nation’s resources between 3 miles and 200 miles off the coast.” If private property rights were allowed, certain areas could be fenced off underwater, which would allow fisherman to cultivate certain stocks of fish. It would even allow fisherman to separate different sizes and types of fish, e.g., to make sure that the bigger, more aggressive fish do not eat smaller fish.

The aforementioned example only deals with a scenario where the property is not owned by any particular actor. What about if property where divvied out by an organization to a group of people to share and work on communally?

This is exactly what happened in early U.S. history with the first groups of settlers. The Virginia company provided property for workers to work and live on and then the product of their labor was put in a common pool. The profits from the goods were then supposed to support the colony and generate income for the Virginia Company. Since the workers did not directly own the property or their labor — everything was shared communally — the settler’s work ethic slowly withered and many began to shirk.

Economic historians Gary Walton and Hugh Rockoff describe how this process arises when there is no private property:

Consider 10 workers, who share ownership of the land and who collectively produce 100 bushels of corn, averaging 10 bushels each for consumption. Suppose that one worker begins to shirk and cuts his labor effort in half, reducing output by 5. The shirker’s consumption, like the other workers’, is now 9.5 (95/10) bushels thanks to the shared management. Though his effort has fallen 50 percent, his consumption only falls 5 percent. The shirker is free riding on the labor of others. The incentive for each worker, in fact, is to free ride, and this lowers the total effort and total output.

This system — of communal ownership — led to staggering numbers of deaths. Only 38 of the original 104 original Jamestown settlers survived the first six months. Two years later when 500 more were sent, 440 were dead within six months. It was not until the establishment of private property — where each man was given three acres and allowed to keep the product of labor, save for a lump-sum tax of two and half a barrel of corn that were contributed to the colony — that there was dramatic turnaround.

The establishment of private property followed Aristotle’s logical ethic: “What is common to many is taken least care of; for all men have greater regard for what is their own than for what they possess in common with others.”

The claim that all nature-given factors — so long as they are scarce — must be open to appropriation is usually met by the reply that certain goods are “collectively” wanted. Along with the idea that certain goods are “collectively” wanted also comes the idea that these goods must be jointly consumed and it is hard to exclude free riders.

Rothbard notes the logical holes in the theory of collective wants and joint consumption:

In one sense no consumption can be joint, for only individuals exist and can satisfy their wants, and therefore everyone must consume separately. In another sense, almost all consumption is “joint.” Baumol, for example, asserts that parks are an example of “collective wants” jointly consumed, since many individuals must consume them. Therefore, the government must supply this service. But going to a theater is even more joint, for all must go at the same time. Must all theaters therefore be nationalized and run by the government? … all modern consumption depends on mass production methods for a wide market. What individuals could buy steel or automobiles or frozen foods, or almost anything else, if enough other individuals did not exist to demand them and make their mass-production methods worthwhile? Baumollian interdependencies are all around us, and there is no rational way to isolate a few services and call them “collective.”

This flies directly in the face of sound economic reasoning. Goods can only be wanted by an individual. The sum of individual wants is then called the demand. A “collective” never does wanting — only an individual does. This collective line of reasoning is pushed even further — under the theory of public goods — to suggest that the free market “fails” in that there are not “enough” competitors to provide a certain good, so it must be provided for by the government.

Typical examples of public goods are roads, courts, police, etc. At one time, most roads in the United States were produced and maintained privately. While the majority are now public — some are still private. Legal systems throughout history have been developed that were completely private.

However, what should be noted is that in these areas the market has not “failed.” People have not been allowed to produce the goods in question because the State holds monopolies on each of these areas.

Hoppe comments that it is impossible to gauge whether government services are provided in an efficient manner for,

No one buys government “goods” or “services.” They are produced, and costs are incurred to produce them, but they are not sold and bought. On the one hand, this implies that it is impossible to determine their value and find out whether or not this value justifies their costs. Because no one buys them, no one actually demonstrates that he considers government goods and services worth their costs, and indeed, whether or not anyone attaches any value to them at all. From the viewpoint of economic theory, it is thus entirely illegitimate to assume, as is always done in national income accounting, that government goods and services are worth what it costs to produce them.

Conservation of Nature-given Factors

Perhaps one of the most common arguments levied against private control of resources can be summed up as the “we owe it ourselves and our children” argument. It is claimed that resources need to be left preserved in their natural state and free from the “reach” of a free market. Yet, as Rothbard notes,

Anyone who uses such a resource at all, whatever the extent, “deprives” some future descendant of the use. “Conservationists,” therefore, call for lower present use of such resources in favor of greater future use … if this argument is adopted, logically no resource subject to depletion could ever be used at all. For when the future generation comes of age, it too faces a future generation. This entire line of argument is therefore a peculiarly absurd one.

Another common criticism of private appropriation of nature-given factors is that individuals and businesses are short-sighted while people in the employ of the State have the long view in mind. This long-term view — it is claimed — allows the State to better plan the use of resources for the future.

However, this line of reasoning is actually backward. Politicians are elected to set terms — two, four, six years, etc. — and have no stake in the capital value of property since they cannot own it. On the other hand, private owners are can invest in the property, which allows them to profit off wise investments, i.e., those that tend to increase profits by satisfying consumer demands. This ability to own the property and calculate the use of the resources on the property via prices allows a business owner to plan for the future.

The reason that a private owner can plan more efficiently, i.e., satisfy more consumer demand, than a democratic or public government, is not only because of the nature of property (private versus public) but also due to the economic law of time preference.

Time preference is a universal part of human action. Since every actor feels the constraint of time — they live, grow old and eventually die — each prefers their ends to be achieved in the shortest possible span of time. Sometimes it is referred to in economic texts as preference for present satisfaction over future satisfaction or present goods over future goods. An actor with low time preference values the future more than the present, whereas an actor with high time preference values the present more than the future.

Since politicians are elected to time-limited positions they will always have a higher rate of time preference than private owners. Hoppe remarks on these two different sets of time preferences:

A democratic ruler can use the government apparatus to his personal advantage, but he does not own it. He cannot sell government resources and privately pocket the receipts from such sales, nor can he pass government possessions on to his personal heir. He owns the current use of government resources, but not their capital value … a president will want to maximize not total government wealth (capital values and current income) but current income (regardless and at the expense of capital values). Indeed, even if he wished to act differently, he could not, for as public property, government resources are unsaleable, and without market prices economic calculation is impossible … a president (the government’s temporary caretaker or trustee) will use up as much of the government resources as quickly as possible, for what he does not consume now, he may never be able to consume.

One final factor comes into play when discussing private versus public use: economic calculation. Prices not only allow a business to plan for the future, but to also use its resources efficiently to satisfy consumer demands at the least possible cost. The pleasing of the consumer is always goal number one, for if there is no consumer then there is no business. Since a business is liable to the consumer it looks to the consumer for signals. Profits and losses signal to that business whether it is satisfying or not satisfying demands.

Prices are a two-way street. Signals are sent from consumers to producers and vice-versa. Economist F.A. Hayek described how the large array of prices on the market communicate information: “The whole acts as one market, not because any of its members survey the whole field, but because their limited individual fields of vision sufficiently overlap [through relative prices] so that through many intermediaries the relevant information is communicated to all.”

A government does not have this built-in free market mechanism. If a government is providing a service it has little to no incentive to be efficient. It cannot go out of business. It can restrict access or use of resource or simply tax the citizen more. Rothbard comments on this:

Since government services are almost never priced so as to clear the market, i.e., equate supply and demand, it tends to price far below the market, and therefore bring about an artificial “shortage.” Since the shortage is manifest in people not being able to find the product, government’s … bent leads it invariably to treat the shortage by turning to coercive restraints and rationing.

Most water supplies to consumers were at one point—quite a few decades ago—provided by private companies. However, over time, most have become monopolized by the State and economic calculation chaos has ensued.

The water supply situation in New York City in 1985 illustrates the point. People started to complain about “shortages.” These “shortages” should not have been surprising. Apartment buildings paid a fixed water fee per apartment — not a fee based on overall use. This gave tenants no incentive to use water economically. Strict controls were placed on water use: people could not use water to wash cars and businesses were required to turn off water-cooled air conditioners at least two hours a day.

If private companies had provided the water the coercive rules would not have been in place. This is why the communication between business and consumers and government and citizens is so different. If government is providing a product — such as water — it asks the citizens to conserve and not use a certain amount of the product. Businesses, on the other hand, never tell consumers to simply stop using a functioning product for the motto of every business is “the customer is always right.”

Instead, prices would be used to communicate data to consumers — a rise in price would indicate that the consumer should start conserving while a fall would indicate that the consumer could adopt a more care-free attitude.

But what about another scenario? What if government did not own the nature-given factor but simply set its price based on some conservation ideal? For example, if the State was worried about oil use it might price oil at a much higher price than it would be on the free market.

Price controls by government take two forms: a maximum or a minimum. A maximum legally sets the highest price at which a good may be sold, whereas a minimum sets the lowest price at which a good may be sold.

Any constraint on the price of sale of a good is a form of control over ownership of a good. F.A. Harper has commented on this: “The corollary of the right of ownership is the right of disownership. So if I cannot sell a thing, it is evident that I do not really own it.”

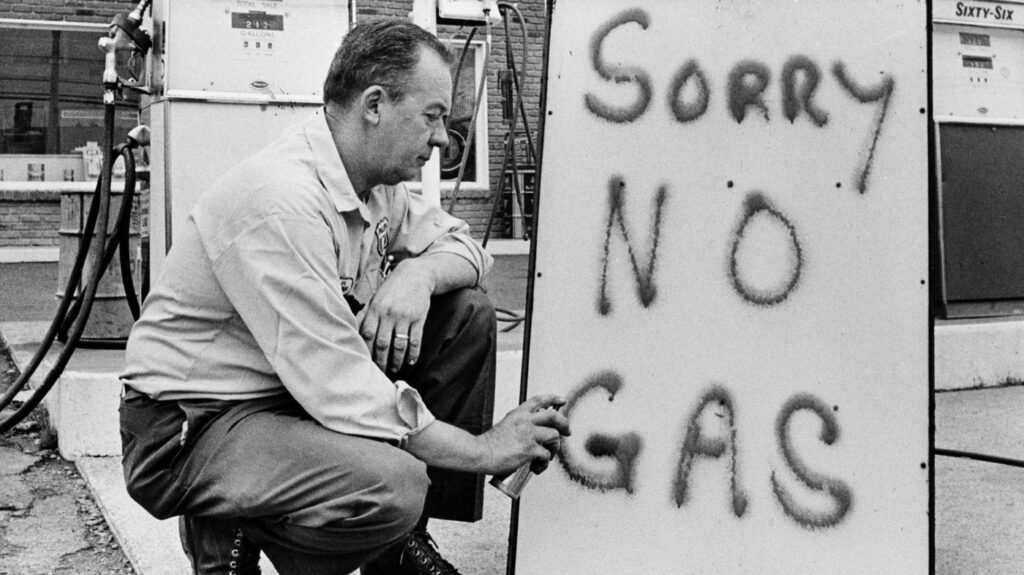

The maximum price strategy, combined with a worry over oil use, resulted in the illogical energy policy of the 1970s. Far from a natural crisis — meaning that there was not “enough” oil on the market — it was the exact opposite: the “crisis” was artificial. At the first sign of the maximum price control, opposite signals were sent out on the free market. Since the price of gas was legally lowered, it encouraged consumers to consume more while it signaled to producers to produce less.

Maximum and minimum price controls only affect the market if these controls lift a good above or below its free market price. For example, if gas normally sells for $2 a gallon, imposing a maximum of $90 a gallon will have no affect. However, if a maximum of $1 a gallon is imposed, an artificial shortage results. Rothbard sums up the convoluted logic of government price controls:

The typical government reason for selective price control—’We must impose price controls on the necessary product so long as it continues in short supply’—is revealed to be an almost ludicrous error. For the truth is the reverse: price control creates an artificial shortage of the product, which continues as long as the control is in existence.

This was coupled with programs such as odd-even rationing based on license plate numbers (various letter and number combinations indicated which day of the week people were allowed to purchase oil), coupon systems for limited amounts of oil (this resulted in a black market for oil coupons) and a proposal to raise the federal driving age to 25.

One control spun into another — when the solution was already available and hard-wired into the free market. If the price controls were eliminated the free market would again begin to approach an equilibrium price that would equate supply and demand. This is exactly what happened around the time Ronald Reagan came into office. The bulk of price controls were eliminated and the “shortages” disappeared.

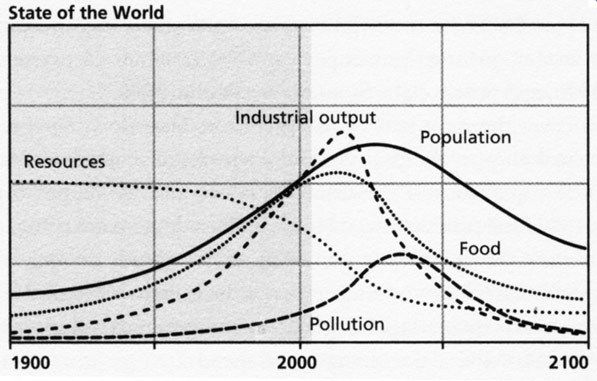

Most conservation talk is rooted in doomsday rhetoric that springs from Malthusian theories. Malthusian theories are usually based on limits-to-growth arguments. They can usually be stated in terms of saying “there is a set number of x for a set number of y.” A free-market is the antithesis of Malthusian theory for Malthusians fear that businesses will “exploit” resources because they only think about the “short-run.”

Examples of these doomsday forecasts are not recent—they have been around for decades. For example, David While, Chief Geologist for the U.S. Geological Survey, said in 1919, “the peak of [American oil] production will soon be passed—possibly within three years.” In 1922, the same agency refined its forecast and said petroleum resources would be exhausted by 1945.

Author Paul Ehrlich claimed in his 1968 book that, “The battle to feed humanity is over. In the 1970s and 1980s hundreds of millions of people will starve to death in spite of any crash programs embarked upon now.” The Club of Rome, in 1972, published the Limits to Growth. It calculated that the world would be out of petroleum by 1992 and natural gas by 1993.

All these claims have one thing in common — they never came to pass. Perhaps what is most telling of these doomsday forecast is the Club of Rome’s report title — ”The Limits to Growth.” Is there truly a limit to growth? If one is only looking at current resource use and current consumption then it is not surprising one would say there are limits. Yet, conditions are constantly changing. People are finding new ways to use current resources in a more efficient manner, new resources are being found and used and rates of consumption can change.

An example of this would be land in a major city, e.g., New York City. Total land has not increased, yet the population of the city continues to grow. How is this possible? When one ventures to such a big city their head immediately turns up and a sudden realization occurs: land space has not increased but people were ingenious enough to build tall buildings. Since space was limited horizontally, they looked vertically. A resource that was thought to be limited — land — has been used in an efficient manner.

Bradley and Fulmer illustrate the illogical nature of stretching out a trend indefinitely:

A common mistake that many make is to project trends into the future as if they will continue forever. The absurdity of making such assumptions can be demonstrated by a simple example. Suppose a ten-pound baby doubles her weight in her first year of life. What reasonable person would become concerned by the fact that, if the child’s growth continued at the same rate (i.e., doubling every year), by age 10 she would weigh more than 5,000 pounds? Obviously, children do not keep growing at the same rate and the rate of change declines without any intervening catastrophe.

One factor left out of doomsday forecasts is human ingenuity. Economist Julian Simon stresses this theme consistently in his writings:

The main fuel for our progress is our stock of knowledge, and the brake is our lack of imagination. The ultimate resource is people—skilled, spirited, and hopeful people, who will exert their wills and imaginations for their own benefit, and so, inevitably, for the benefit of us all.

This explains why many are at a loss to explain the following observation: population has increased yet instead of the standard of living declining it has been rising steadily.

Property, Pollution and Law

Up until now, the discussion has entirely focused on the appropriation of private property and its use. Once pollution enters the equation, the concept of property does not get thrown out the window. It is quite the contrary — it comes to the forefront. In constructing a definition of pollution — for there must be a logical definition before the issue can be analyzed — the term of “property” must be used for everything stems from property.

Fortunately, Robert Poole gives a logical definition of pollution “as the transfer of harmful matter or energy to the person or property of another, without the latter’s consent.”

If pollution is recognized as a property issue, then analyzing the problem becomes clear. Roy Cordato illustrates this:

Whether it’s the problem of a factory discharging chemicals into a river and destroying the fishing downstream, or the odors from an animal farm fouling the air in nearby housing developments, or Coase’s classic cases of straying cattle or railroads emitting sparks, they can all be seen as interpersonal conflicts. In each case, people are simultaneously making conflicting plans with respect to the use of a physical resource, and it is this conflict that allows us to identify what is transpiring as an environmental problem.

What about property can be judged in cases of pollution? The litmus test for cases of pollution—that is, violation of property rights—is the physical integrity of a piece of property. Professors Hoppe and Block spell this out clearly:

Whenever one says “I own a house,” what one normally means is: I have the right to determine how that particular resource … is to be employed; I am free to employ it for any purpose whatsoever, provided that in doing so I do not impair the physical integrity of the resources owned by others … Property rights, then, are commonly conceived of as extending to specific, physical objects.

Yet most cases of pollution today are not measured in terms of the physical integrity of the property, but upon methodologically unsound concepts such as “benefit-cost analysis,” “contingent valuations” and “social costs.”

The first concept — benefit-cost analysis — is cited frequently in environmental literature and policy. Simply stated, “it is a process by which federal agencies (usually regulators such as the EPA) compare the net benefits and the costs of a proposed action — usually a regulatory law — in order to determine whether the benefits exceed the costs.” It is claimed by Scott Farrow and Michal Toman to have a “solid methodological footing and provides a valuable performance measure for an important governmental function, improving the well-being of society.”

How can something have “solid methodological” footing when it is making inter-personal subjective evaluations? For example, if the State passes a law that does not permit a logging company to harvest timber, have the benefits outweighed the costs?

For both sides the question is completely subjective. To one actor the benefit is being able to harvest timber and then fashion it into products to sell to consumers. To another actor the benefit is to preserve the forest in a more “natural” state. For one the cost is a loss of income, i.e., unsatisfied consumer demand; for the other the cost is a loss of their subjective definition of beauty.

However, many reply that there is a solution to this problem and it is contingency valuation. This method involves placing a monetary value on an “environmental amenity whose use or destruction would deprive others of its future availability.” Rosenbaum says,

In a typical case, a representative segment of the relevant public would be asked how much they would be willing to pay to prevent haze over a national park, to avoid an oil spill, or to preclude some other environmental problem. Through statistical procedures, a monetary value would then be assigned to an environmental amenity based on these public valuations.

This line of analysis suffers from the same problem as benefit-cost analysis — it is looking at subjective valuations between different actors. Also, monetary value can only be assessed by the process of demonstrated preference. People can say that they value a policy that prevents haze or they think the beauty of a national forest is X amount — that does not mean it is that amount.

Subjective valuations are fine in the case of an act of exchange, i.e., where both parties agree to the terms and exchange property, but it cannot be applied when no trade is actually taking place.

A third line of analysis comes from legal and economic theorists associated with the University of Chicago such as Ronald Coase, Harold Demsetz and Richard Posner. It tries to place a monetary emphasis on property rights violations known as “social costs.” The entire approach is succinctly laid out by economist Ronald Coase:

The question is commonly thought of as one in which A inflicts harm on B and what has to be decided is: how should we restrain A? But this is wrong. We are dealing with a problem of a reciprocal nature. To avoid to harm B would inflict harm on A. The real question that has to be decided is: should A be allowed to harm B or should B be allowed to harm A? The problem is to avoid the more serious harm.

Hoppe looks at one of Coase’s famous examples as well as one of Posners’ — both arguing for a “social cost” approach:

Suppose the crop loss to the farmer, A, is $1000, and the cost of a spark apprehension device (SAD) to the railroad, B, is $750. If B is found liable for the crop damage, B will install the an SAD or cease operations. If B is found not liable, then A will pay a sum between $750 and $1000 for B to install an SAD. Both possibilities result in the installation of an SAD. Now assume the numbers are reversed: the crop loss is $750, and the cost of an SAD is $1000. If B is found liable, he will pay $750, but he will not install an SAD. And if B is not found liable, A is unable to pay B enough to install a SAD.

… Coase, Demsetz and Posner demand that courts assign property tights to contesting parties in such a way that “wealth” or the “value of production” is maximized. For the case just considered this means that if the cost of the SAD is less than the crop loss, then the court should side with the farmer and hold the railroad liable. Otherwise, if the cost of the SAD is higher than the loss in crops, then the court should side with the railroad and hold the farmer liable. Posner offers another example. A factory emits smoke and thereby lowers the residential property values. If property values are lowered by $3 million and the plant relocation cost is $2 million, the plant should be held liable and forced to relocate. Yet if the numbers are reversed — property values fall by $2 million and relocation costs are $3 million — the factory may stay and continue to emit smoke.

Again, like the two previous approaches — benefit-cost analysis and contingency valuation — what is being looked at is inter-personal subjective valuations, not the physical integrity of the property.

A constant theme in environmental cases is to stress the loss of value to one’s property — whether it be a person’s physical body or the property on which their house sits. Value decisions such as these must be completely avoided — at the start of legal action — because there is no such thing as objective value in terms of property.

For while every person can, in principle, have control over whether or not his actions cause the physical attributes of other persons’ property to change, control over whether or not his actions affect the value of other people’s property rests with other people and their valuations. Consequently, it is impossible to ever know in advance if one’s planned actions were permitted or not.

The following example illustrates the point. Company A operates a chemical plant. Individual B owns property one mile away from the plant. In the process of its business, Company A buries chemicals in the ground. The chemicals from the barrels seep through the ground and end up in the soil of B’s property. This causes the plants on B’s property to die. The physical integrity of B’s property has been violated. A has trespassed on B’s property and therefore B should be able to seek legal action against A.

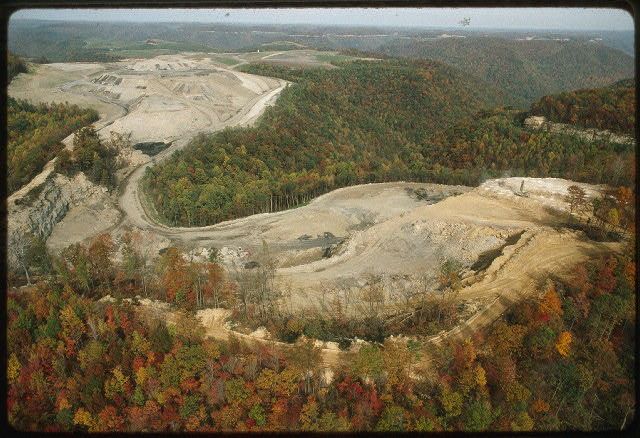

Another example can show the difference between the subjective valuation approach versus the physical integrity approach. Suppose that an irresponsible strip mining company starts business near a small town.

There are two approaches that can be taken: one can accuse the strip miner of damaging the physical integrity of one’s property or one can accuse the strip miner of damaging one’s romantic ideal of what nature should be. The former is a more airtight case than the latter. If one bases their case on the fact that coal is mined, then piled near streams of water which in turn contaminates those streams or if the land becomes so denuded that it results in mud slides, then the case is rooted in the physical integrity of multiple forms of property being damaged.

If one goes the other route — that the natural beauty of the landscape or views have been “damaged” — then that person is standing on shaky, subjective ground at best. What is beautiful to one person may be utterly appalling to the next.

To say that one can own a view is illogical. A person owns their property — such as their house and the acreage upon which it sits — they do not own the aesthetics of their next door neighbor nor those of a business a block or two miles away.

It is time to revisit the establishment of private property — the homesteading principle — for it establishes that pollution, as long as it is constrained to one’s own property, is permissible. Remember, Poole defines pollution only as something that affects someone else’s property without their consent.

First, consider an uncommon form of pollution — noise. Rothbard explains a plausible scenario:

Suppose, for example, that an airport is established with a great deal of empty land around it. The airport exudes a noise level of, say, X decibels, with the sound waves traveling over the empty land. A housing development then buys land near the airport. Some time later, the homeowners sue the airport for excessive noise interfering with the use and quiet enjoyment of their houses.

… the airport has already homesteaded X decibels worth of noise. By its prior claim, the airport now “owns the right” to emit X decibels of noise in the surrounding area. In legal terms, we can then say that the airport, through homesteading, has earned an easement right to creating X decibels of noise. This homesteaded principle is an example of the ancient legal concept of “prescription,” in which a certain activity earns a prescriptive property right to the person engaging in the action.

… if the airport starts to increase noise levels, then the homeowners can sue or enjoin the airport from its noise aggression for the extra decibels, which had not been homesteaded.

This same homesteading principle is hard to apply to the most well-known type of pollution: air pollution. For noise can be constrained — that is, controlled and contained to a set amount of property. Air pollution circulates and crosses property boundaries.

The first task in prosecuting an air polluter that is polluting invisible particles must be showing, beyond a reasonable doubt, that the pollutant has damaged the physical integrity of one’s property, whether it be parts of one’s own body such as their lungs, heart, etc. or parts of their property, e.g., pollutants that strip paint of buildings.

Once this can be done, then a legal action can be sought. Air polluters can also be prosecuted that send noxious odors, smoke or any other visible matter onto another’s property, for it is a form of trespassing. Rothbard notes that “these particles can be seen, smelled, touched, and should therefore constitute invasion per se, except in the case of homesteaded air pollution easements.”

The distinction of harmful invisible and visible property trespassing from one party to the next illustrates an important point: there are many types of matter that are invisible but not harmful. An example of this is radio waves. Rothbard notes,

that these boundary crossings do not interfere with anyone’s possession, use or enjoyment of their property … we must refine our concept of invasion to mean not just boundary crossing, but boundary crossings that in some way interfere with the owner’s use or enjoyment of this property.

The two most common programs to combat air pollution — having government tax the polluter or allowing the exchange of pollution permits — are fundamentally flawed. Both assume that the State owns the air.

Cordato notes that “In the case of the tax, a central authority must know in advance the exact amount of the externality costs being imposed by the polluter … In the case of tradeable permits, the knowledge requirements are essentially the same. This is because the central authority must first determine the ‘efficient’ level of emissions for the particular pollutant.”

At the beginning of the discussion, however, it was shown that air is a general condition of human welfare. This means no one owns it. When one files suit against an air polluter they are not defending all the air, but defending their property from contaminants in the air that trespass onto their property. This reduces all cases of air pollution and fundamentally any form of pollution to cases of one person taking another to court over property rights violations, i.e., tort law.

Rothbard distinguishes between the different form a suit may take: “the aggressor and only the aggressor should be liable, and not the employer of an aggressor, provided, of course, that the tort was not committed at the direction of the employer.”

Private property — a logically-deducible axiom — provides a valuable rubric for discussing environmental issues. Any straying from it into “collective” or “public use” ideas leads to abstract and arbitrary, i.e., ad hoc decrees, on the “proper” use and ownership of particular nature-given factors within a set area.

At each area of analysis presented — whether it be property in person and goods, nature-given factors, the conservation of resources or pollution—an understanding of the concept of private property allows one to go logically from A to B and understand the issue at hand.